Whether you’re already running an online business or getting ready to launch one, there are a lot of moving parts. We know it can feel overwhelming. You need essentials to manage your legal, banking, and accounting needs. And you need quick setup from reliable companies with 5-star reputations and service that’s there when you need it. We have you covered. This article will give you the must-have tools to master your legal, banking, and accounting needs.

Choose a Business Structure

Deciding on a business structure is like laying the groundwork for your house. It’s crucial because it affects everything from your day-to-day operations to taxes, and how much of your personal assets are at risk. You’ve got options like Sole Proprietorship, Partnership, LLC, and Corporation. Each has its perks and considerations. We’ll walk you through some of the risks and benefits of a sole proprietorship and LLC, two of the most common.

A sole proprietorship is a business structure owned and operated by one individual, without any distinction between the owner and the business entity. It’s the simplest form of business under which one can operate a company.

The ease of setup, minimal regulatory paperwork, and direct control over all business decisions are significant advantages. However, a sole proprietorship also comes with notable drawbacks. The most glaring is the issue of personal liability; as there’s no legal separation between the owner and the business, any debts or legal claims against the business are the personal responsibility of the owner.

This risk extends to all personal assets, including savings and property. Additionally, sole proprietors might face challenges in raising funds since they can’t sell stock, and loans are personally guaranteed.

An LLC (Limited Liability Company) offers a more flexible business structure that combines the benefits of both a corporation and a partnership or sole proprietorship. It provides its owners, commonly known as members, with limited liability protection in addition to many other benefits.

- Limited liability protection for members, safeguarding personal assets against business debts or legal claims.

- Financial and tax flexibility, allowing profits and losses to be passed directly to members without corporate taxes.

- Reduced regulatory and paperwork requirements compared to corporations.

- Operational flexibility, with no need for a board of directors or annual meetings, allowing members to structure the company as they wish.

- Accessible for small to medium-sized businesses, blending the benefits of corporations with the simplicity of sole proprietorships or partnerships.

An LLC offers a good balanced blend of flexibility, simplicity, and protection. It uniquely combines limited liability protection, which shields member’s personal assets from business-related debts and legal claims, with the financial and tax benefits of a pass-through entity.

LLCs have less paperwork vs corporations, while also providing operational flexibility to customize business operations. The LLC structure, therefore, represents a compelling choice for entrepreneurs seeking the protective features of a corporation alongside the efficiency and tax advantages of a sole proprietorship or partnership.

Decide whether you’ll operate as a sole proprietorship. Each has its implications for liability, taxes, and operations as you can see in the chart below.

| Sole Proprietor | LLC | |

|---|---|---|

| Formation: | Simple | State Filing |

| Cost: | Free or DBA Filing Fee | $50-$200 |

| Taxes: | On Personal Return | Personal or LLC |

| Legal Protection: | None | Can Shield Assets |

| Credit: | Only in Personal Name | In Business Name |

Download our worksheet to help you decide and if you’re still unsure a consult with a legal advisor or accountant can help you make an informed decision.

[purchase_link id=”11050″ style=”button” color=”blue” text=”Free Download”]

Bizee Business Formation

Bizee simplifies the complex process of forming a Sole Proprietorship or an LLC, making it more accessible and less daunting for entrepreneurs. This platform streamlines the paperwork and reduces the time required to establish your business formally.

With Bizee, you’ll receive step-by-step guidance throughout the entire process, from selecting the right state for incorporation to filing the necessary documents. Their team of experts is always on hand to answer any questions, ensuring you’re well informed at every stage.

You’ll get customizable operating agreements and essential legal document templates to secure your business’s foundation. The goal is to provide you with peace of mind, allowing you to focus on growing your business while your legal formation has the potential to protect everything you work so hard for.

Making the right choice about your business structure is fundamental to your success and peace of mind. Whether you lean towards an LLC for its flexibility and protection, or a sole proprietorship or another structure that better fits your business model, the key is to make an informed decision.

By securing a solid legal foundation for your venture, you’re not just protecting your business; you’re setting the stage for its future growth and ensuring that you can focus on what you do best. Take the next step confidently, knowing that you’ve laid the groundwork for your business to thrive.

Open Your Business Checking Account

Open a business bank account to keep your personal and business finances separate. This step is crucial to keep your finances organized but even more so for maintaining the limited liability protection of an LLC. With a business bank account, you can accurately track your company’s income and expenses, making tax filing easier and more straightforward.

- Simplified Tax Preparation: Segregates business transactions from personal ones, making it easier to file taxes.

- Enhanced Credibility: Establishes your business as a more credible entity in the eyes of clients, lenders, and vendors.

- Limited Liability Protection: Helps in maintaining the LLC’s status, safeguarding personal assets from business liabilities.

- Efficient Expense Management: Allows for the tracking and management of business expenses, aiding in financial planning and analysis.

- Access to Business Loans: A business account paves the way for building a credit history, crucial for loan approvals.

- Professionalism: Enables businesses to accept payments and pay bills under the company name, boosting professionalism.

- Financial Tools: Provides access to business financial tools, such as online banking, mobile deposits, and employee debit cards.

Opening a business bank account is a key step for any online business, offering substantial advantages ranging from simplified tax preparation to enhancing the entity’s credibility. Not only does it bolster the LLC’s protection (if you form one) by separating personal and business finances, but it also facilitates efficient expense management, aids in the acquisition of business loans through credit history establishment, and projects a professional image.

Additionally, the access to specialized financial tools designed for business operations significantly streamlines financial management tasks, allowing business owners to concentrate on growth and operational excellence.

Relay Financial Business Checking

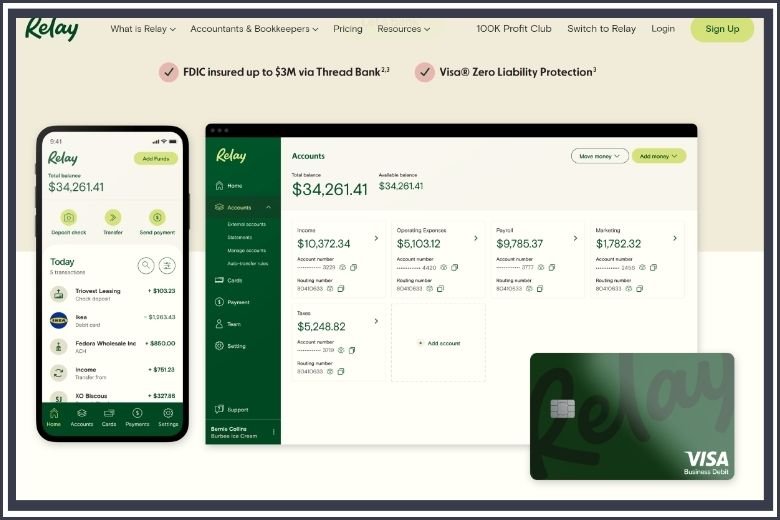

When you opt for Relay Financial business checking, you get zero monthly fees and powerful features like multi-user access and the ability to open multiple accounts — ensuring that your finances are always organized and accessible.

Setting up a Relay Financial Business Checking account is straightforward and tailored for busy entrepreneurs, with:

- No Monthly Fees: Enjoy banking with no hidden charges, keeping your overhead costs low.

- Multi-User Access: Grant access to multiple users, facilitating seamless collaboration among your team members.

- Multiple Accounts Creation: Easily organize finances by creating separate accounts for different aspects of your business.

- Online and Mobile Banking: Access your accounts anytime, anywhere, ensuring that you’re always connected to your financial information.

- Instant Account Setup: Start managing your business finances quickly with an easy and fast account setup process.

- Enhanced Security: Benefit from industry-leading security measures to protect your financial data and transactions.

- Custom Financial Tools: Utilize tailored financial tools designed to meet the unique needs of your business, from expense tracking to invoicing.

Start by visiting the Relay Financial website and selecting the Business Checking Account option. From there, you’ll be guided through a simple application process, which requires basic information about you and your business.

Establishing a business checking account is a practical step towards creating a robust financial foundation for your online business. You’ll find it easier to focus on growing your business. The right financial tools can make a significant difference in your business’s efficiency and success. A business checking out is a good step towards securing your financial future.

Set Up Your Bookkeeping Software

Bookkeeping software will simplify tracking your income, expenses, and tax season. It will help you keep your finances organized and simplify the process of generating financial reports for your online business no matter where you are in the process– from startup to expansion. Bookkeeping software gives you:

- Automated Transactions: Automatically record your sales and expenses, saving you time and reducing errors.

- Financial Overview: Get a real-time view of your business’s financial health, so you know where you stand at any moment.

- Tax Preparation Simplified: Easily organize your financial records, which can be a lifesaver during tax season, ensuring you’re prepared and potentially saving money.

- Efficient Invoicing: Create and send professional invoices directly to your clients, streamlining the payment process.

- Expense Tracking: Keep an eye on your spending to identify where you can cut costs and increase profitability.

- Secure Data Storage: Your financial data is stored securely in the cloud, providing both safety and easy access whenever you need it.

By integrating accounting software into your online business, you’re not just investing in a tool; you’re setting up a system that supports growth and simplifies financial management. It automates the grunt work of bookkeeping, provides valuable insights into your business’s financial health, and aids in strategic planning by highlighting trends and patterns.

Maximize Efficiency with FreshBooks

Leveraging the right tools can drastically enhance the operational efficiency of your online business, and FreshBooks is an ideal accounting software tailored for small business needs.

It offers an intuitive, user-friendly interface that simplifies invoicing, expense tracking, and time management. The real-time financial reporting features of FreshBooks provide clear insights into your business’s financial health, enabling informed decision-making.

- Easy Invoicing: Create professional, customizable invoices in a few clicks, allowing more time to focus on teaching and less on paperwork.

- Efficient Expense Tracking: Automatically track expenses to keep a close eye on your tutoring business’s financial health without manual input.

- Time Tracking Integration: Monitor how much time you’re spending on each tutoring session to better manage your schedule and billing.

- Seamless Payment Processing: Offer your students a variety of convenient payment options, making transactions smooth and straightforward.

- Insightful Financial Reports: Access comprehensive financial reports to understand your business’s profitability and identify areas for growth.

- Cloud-Based: Access your financial information from anywhere, at any time, ensuring you’re always connected to your business’s pulse.

To begin using FreshBooks, visit their website and sign up for an account. Choose the plan that best suits your needs; they offer various options depending on the size of your business and the features you require. The setup process involves a few quick steps to input your business information and integrate any necessary financial accounts.

Once set up, FreshBooks offers comprehensive tutorials and customer support to help you make the most out of your accounting software, streamlining financial management and ensuring your online business is on the path to financial clarity and success.

Whether you’re looking to streamline your invoicing process, keep better track of your expenses, or just save valuable time during tax season, accounting software is a smart move for any entrepreneur eager to take their business to the next level.

Wrapping Up and Next Steps

The right tools in your arsenal can transform the way you manage the crucial aspects of your business. By choosing trusted partners for your legal, banking, and accounting needs, you’re not just making your day-to-day operations smoother—you’re securing the foundation of your business. Remember, success in the online world relies not only on the quality of your product or service but also on how well you handle the behind-the-scenes. Equip yourself with these essentials, and you’re setting yourself up for a smoother, more efficient path to success. Ready to take the next step? Your business deserves the best, and now, you know exactly where to find it. ♥

For additional resources, be sure to explore more free how-to guides, tools, and templates in our online business hub. Whether you’re looking to refine your marketing strategies, improve customer engagement, or streamline your operational processes, our resources are here to support every phase of your online business growth. Dive into our business hub today!