Starting an LLC is a big step towards turning your business dreams into reality. In this next section, we’ll walk you through the process, step by step, making it as simple and straightforward as possible.

Whether you’re opening an LLC for the first time or you’ve been through this before, our guide aims to demystify the process, ensuring you have all the information you need to successfully establish your LLC. From understanding the paperwork to navigating legal requirements, we’ve got you covered.

The process generally involves:

Choosing a Name

When creating an LLC, you’ll want to choose a name that complies with state rules and is distinguishable from other businesses. The name should also reflect the nature of your business and be appealing to potential customers.

When it comes to picking a name for your LLC, think of it as the first impression your business will make. It’s not only about following state laws but ensuring your business name stands out and tells a story about what you do.

Searching for Name Availability

Before finalizing your LLC’s name, you must ensure it’s not already in use or too similar to another business’s name. This step is crucial to avoid legal disputes and confusion in the market. Here’s how you can search for name availability:

- State Database Search: Begin by visiting your state’s business entity search website. Most states provide an online database where you can search for business names to see if yours is unique.

- Trademark Check: Conduct a search through the United States Patent and Trademark Office’s (USPTO) database to ensure your chosen name doesn’t infringe on any registered trademarks, which could lead to legal issues.

- Web Domain Availability: If you plan to have an online presence, checking the availability of your business name as a web domain is wise. Even if you’re not ready to create a website today, securing your desired domain name now prevents others from taking it.

- Social Media Username Check: For branding consistency, check the availability of your business name on popular social media platforms. This step ensures you can market your business effectively and cohesively online.

It’s important when opening an LLC to perform a thorough search across these platforms. It can save you from potential legal hassles and help establish a strong, unique brand identity. The search for the availability of your business name is a foundational step in the process of establishing your LLC. By diligently conducting searches across state databases, the USPTO, web domains, and social media platforms, you can avoid legal complications and market confusion.

This not only secures your brand’s unique identity but also paves the way for a consistent and recognizable online presence. Taking these steps seriously ensures that your business name accurately reflects your brand while also complying with legal requirements, setting a solid foundation for your business’s future growth and success.

Creating Your Documents

Once you have selected a name for your LLC, the next critical step is to create your Operating Agreement, Articles of Organization, and any other necessary founding documents.

Articles of Organization

The Articles of Organization are your official start in formalizing your business under the law. Essentially, they are a set of documents you file with your state’s Secretary of State office to legally establish your LLC. Think of it as your business’s birth certificate. It outlines basic information about your business, like the name of your LLC, the business address, and details about who will manage it.

You’ll also include the names of the members (owners) and how long you plan for your business to exist, which can be perpetual. Filing these documents is a crucial step, and while it might sound complicated, the process is usually straightforward. Just make sure you follow your state’s specific guidelines to ensure everything is set up correctly from the start.

Get our sample Articles of Organization Template to jumpstart your LLC’s official registration process, and make sure you’re on the right path to establishing your business’s legal foundation.

Operating Agreement

The operating agreement is a key document for your LLC because it outlines the ownership and member duties of your LLC. It acts as a blueprint for how the business will be operated and managed and includes details on the allocation of profits and losses, meeting schedules, and what happens if an owner wants to sell their interest in the company.

Even though not all states require an operating agreement, it’s highly recommended to have one to ensure all members are clear on the operations and expectations. This document serves as a safeguard for all members by setting clear rules and procedures for the business, thereby minimizing misunderstandings and disputes.

Download our sample Operating Agreement for a robust framework that details the governance structure of your LLC, clarifying roles, responsibilities, and processes.

Your LLC documents are a significant step toward securing your business’s legal foundation. You’re creating a comprehensive framework that ensures clarity and organization in governance, roles, and responsibilities, ensuring a smooth operational flow for your business.

Filing Paperwork

Filing Articles of Organization with your chosen state:

After creating your Operating Agreement, the next essential step in starting an LLC is to file the Articles of Organization with the state where your LLC will be headquartered. This legal document officially establishes your business as an LLC under state law.

The filing process typically involves submitting a form either online or by mail, along with a filing fee that can vary from state to state. The Articles of Organization usually require basic information about your LLC, including the business name, address, and the names of its members.

Some states might also ask for the LLC’s purpose, though a general statement such as “to conduct any lawful business” is often sufficient. Once filed and approved, your LLC is legally recognized, allowing you to move forward with setting up bank accounts, obtaining licenses, and beginning your business operations.

Publishing Your LLC

Complying with your state’s publication requirements or setting up a public notice.

Certain states require that newly formed LLCs publish a notice in a local newspaper of their intention to operate. This step in starting an LLC, known as a publication requirement, is meant to publicly announce the formation of your LLC to the community. The specifications for this requirement vary by state, including the duration the notice must run and the types of publications that are acceptable.

Typically, the notice must include basic information about the LLC, such as the name, address, and sometimes the names of the members. After the publication period, proof of publication must often be submitted to the state’s business filing office to complete the LLC formation process. This unique requirement, while not widespread, is an important step to fully establish an LLC in jurisdictions where it is mandated.

Getting an EIN

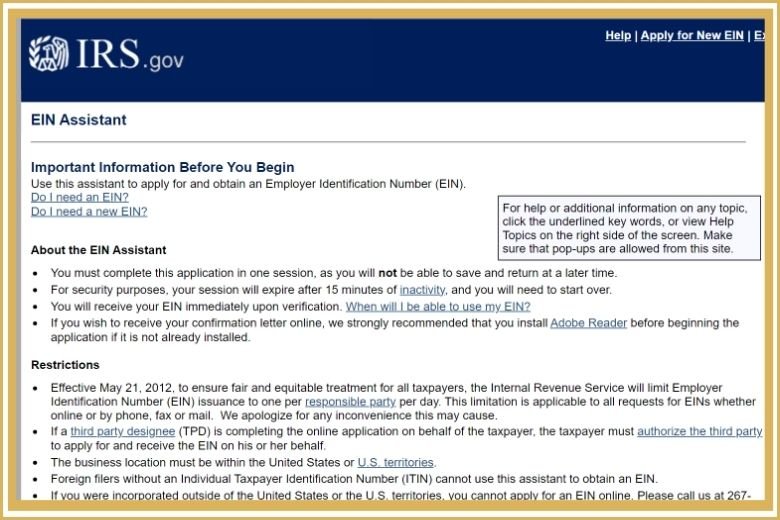

Applying for an EIN (Employer Identification Number) from the IRS for tax purposes.

Obtaining an Employer Identification Number (EIN) is a straightforward process that significantly benefits your LLC. This federal tax ID is not just a requirement for hiring employees; it also facilitates important business activities like opening a bank account and handling taxes.

The IRS provides this number for free, and you can apply for your EIN online, via fax, or mail, with the online application being the quickest method. Once your application is processed, you will receive your EIN immediately when applying online. It’s essential for keeping your business and personal finances separate, making tax time less stressful and more organized.

Establishing a Business Checking Account

Opening a business checking account is a pivotal next step in opening your LLC after obtaining your EIN. This account will serve as the primary repository for your LLC’s operating finances, allowing you to manage cash flow, expenses, and revenues more effectively.

It’s crucial to choose a bank that understands the needs of small businesses, offering low fees, easy access to funds, and perhaps even additional perks like interest on balances or merchant services.

When opening the account, you’ll typically need to provide your EIN, a copy of the LLC formation documents, and possibly a resolution authorizing you to open the account on behalf of the LLC. Relay Financial has a great business checking account with no fees, no minimum opening deposit, and free checks.

Establishing a business bank account not only simplifies financial management but also reinforces the separation between your personal and business finances, further protecting your personal assets.

Getting Business Insurance

Securing the right insurance coverage is a critical step in protecting your LLC from unforeseen risks and liabilities. Different types of insurance, such as general liability insurance, professional liability insurance, and property insurance, can safeguard your business assets, income, and even your employees.

General liability insurance protects against common business risks like accidents or injuries that can occur on business premises. Professional liability insurance, also known as errors and omissions insurance, is essential for businesses providing professional services, as it covers claims of negligence or failure to perform professional duties. If your LLC owns physical assets such as equipment or a workspace, property insurance will protect these from damage due to events like fire, theft, or natural disasters.

It’s crucial to assess your business’s specific risks to determine the right types and levels of coverage needed, consulting with an insurance company that understands your industry can provide personalized advice to ensure your LLC is adequately protected. Next Insurance is our go-to for business coverage.

Designating a Registered Agent

Your LLC will need a registered agent, who is responsible for receiving official legal and tax documents on behalf of the company. This can be either an individual or a corporation with a physical address in the state where you’re forming your LLC.

Choosing the right registered agent is an essential part of opening your LLC. This agent acts as your business’s point of contact with the state, handling crucial documents like legal summons, lawsuit notifications, and important government communications. Ideally, your registered agent should be reliable and always available during business hours to ensure no critical document gets missed.

While you can serve as your own registered agent, hiring a professional service can offer peace of mind, especially if you don’t have a fixed business location or prefer to keep your address private. Professional registered agents also help maintain your business’s compliance with state regulations by reminding you of filing deadlines and compliance requirements.

Quick and Easy Online LLC Formation

Bizee can streamline the process, offering you a hassle-free path to establishing your LLC. Bizee specializes in business formation services, including the crucial step of appointing a registered agent. The benefits of using Bizee are manifold. Firstly, Bizee simplifies the intricacies of legal and compliance requirements, ensuring your LLC is properly set up without missing any vital steps. Their expertise in handling paperwork, deadlines, and compliance issues reduces the risk of costly mistakes, allowing you to focus on the growth of your business.

You’ll also get professional registered agent service with Bizee. This ensures that all your important legal and tax documents are managed professionally, maintaining your business’s good standing with the state and protecting your privacy. Their reliable service means you won’t miss any critical notices or deadlines, which is essential for the smooth operation of your LLC.

What’s Included with Bizee LLC Formation Service:

- Professional registered agent service, ensuring privacy and compliance

- Filing of Articles of Organization with the state

- Customized Operating Agreement tailored to your business needs

- Assistance with obtaining an Employer Identification Number (EIN) from the IRS

- Compliance alerts for important filing deadlines and requirements

- Unlimited customer support from experienced professionals

- Access to additional business services such as business banking and accounting

We recommend Bizee for its convenience, reliability, and expertise. By choosing Bizee, you gain peace of mind knowing that all aspects of your LLC formation are managed efficiently. This allows you to devote your energy to what matters most – growing your business.

Wrapping Up and Next Steps

You’ve got the essentials now to kickstart your LLC, from paperwork insights to legal know-hows. Remember, every big business started with a simple decision to begin. Your venture into forming an LLC is the first step towards realizing your entrepreneurial dreams. Stay focused, follow these guidelines, and you’ll be on your way to building something truly significant.

If you go with Bizee, they can take the formation burden off your shoulders, so you can zero in on what you do best—innovating, expanding, and leading your business to success. In our experience, the DIY route to LLC formation can be overwhelming to the point of putting it off. The worst thing you can do is nothing. Reach out to Bizee, and start your business on the right foot, secure in the knowledge that all the technical legalities are handled with the utmost care and professionalism.

Your successful business journey begins with a solid foundation, and we’re here to help you build it. Check us out for more business ideas and toolkits for quick start success.