BILL Small Business Credit Card

Starting a business is an adventure, and we know how tough it can be to manage your expenses while keeping your operations smooth. That’s where the BILL Small Business Credit Card comes in handy. It’s not just a credit card; it’s like a partner that understands the highs and lows of running a startup. With this card, you can handle your business expenses effortlessly, giving you more time to focus on what truly matters – growing your business.

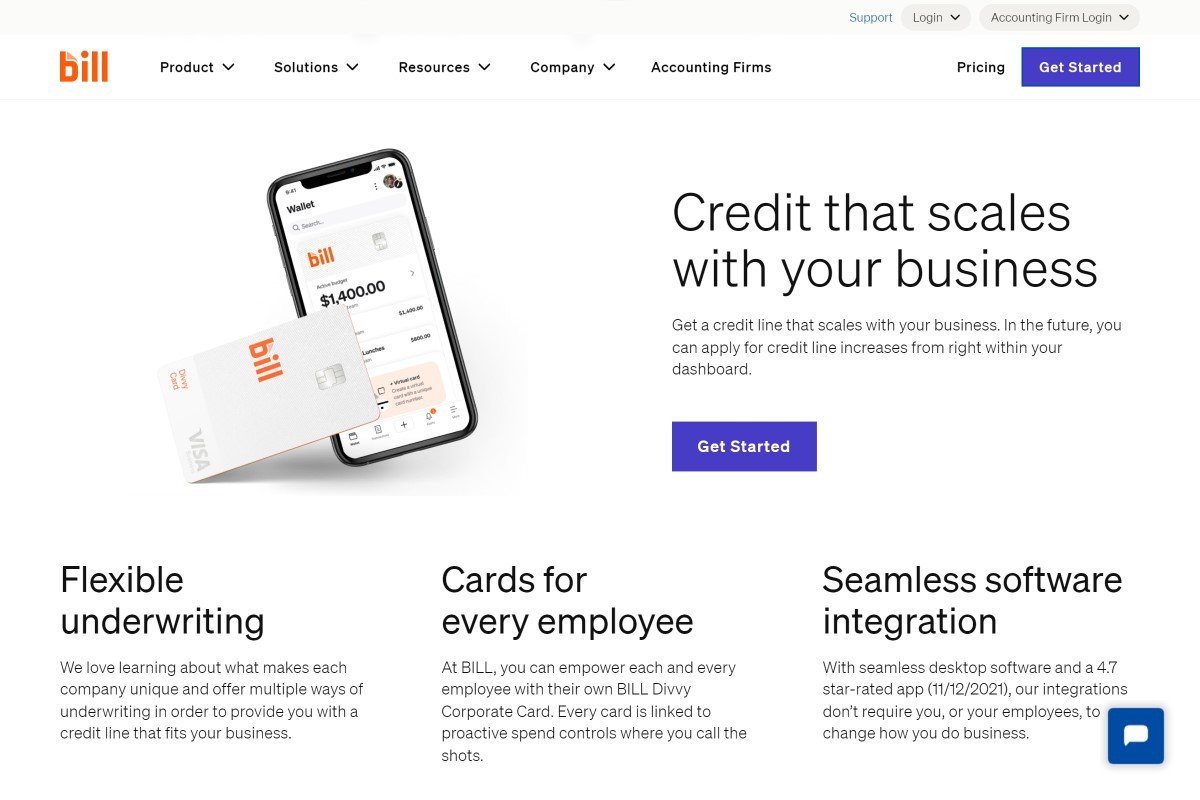

What sets the BILL Small Business Credit Card apart is its simplicity and the value it brings to your young enterprise. Whether you’re stocking up on office supplies, paying for software subscriptions, or covering travel costs, this card makes every transaction smoother. Plus, with an easy-to-use platform, you can track your spending and manage your finances in a snap. No more wrestling with complex statements at the end of the month!

Key Features:

- No annual fee, keeping your overhead low.

- Flexible credit limits to grow with your business needs.

- Easy online account management for hassle-free use.

- Rewards points on every purchase, redeemable for cash back, travel, and more.

- Free employee cards to streamline spending and accounting.

Benefits:

- Improved cash flow with generous payback terms.

- Earn rewards for spending on everyday business needs.

- Enhance your credit score with responsible use, opening doors to more financing options.

- Save time with streamlined accounting features, integrating seamlessly with your financial software.

- Exclusive access to special deals and offers from partner businesses.

Choosing the BILL Small Business Credit Card is more than just getting a means to pay your bills; it’s about empowering your business to thrive in today’s competitive market. With no annual fee, a flexible credit line, and rewards that cater to your business needs, it’s designed to be the financial tool you can rely on.

Don’t miss out on the opportunity to streamline your spending, boost your credit score, and earn rewards all while keeping your business’s financial health in check. Visit BILL Small Business Credit Card to get started and take the first step towards a more organized and financially savvy business future.

Business Credit Cards

These cards can help you earn rewards, get cash back, and keep track of spending all in one place. Plus, they come with friendly terms that make them easy to use, even if you’re new to business credit. Check out these other business credit cards from top-rated companies and see how they can help your business grow.