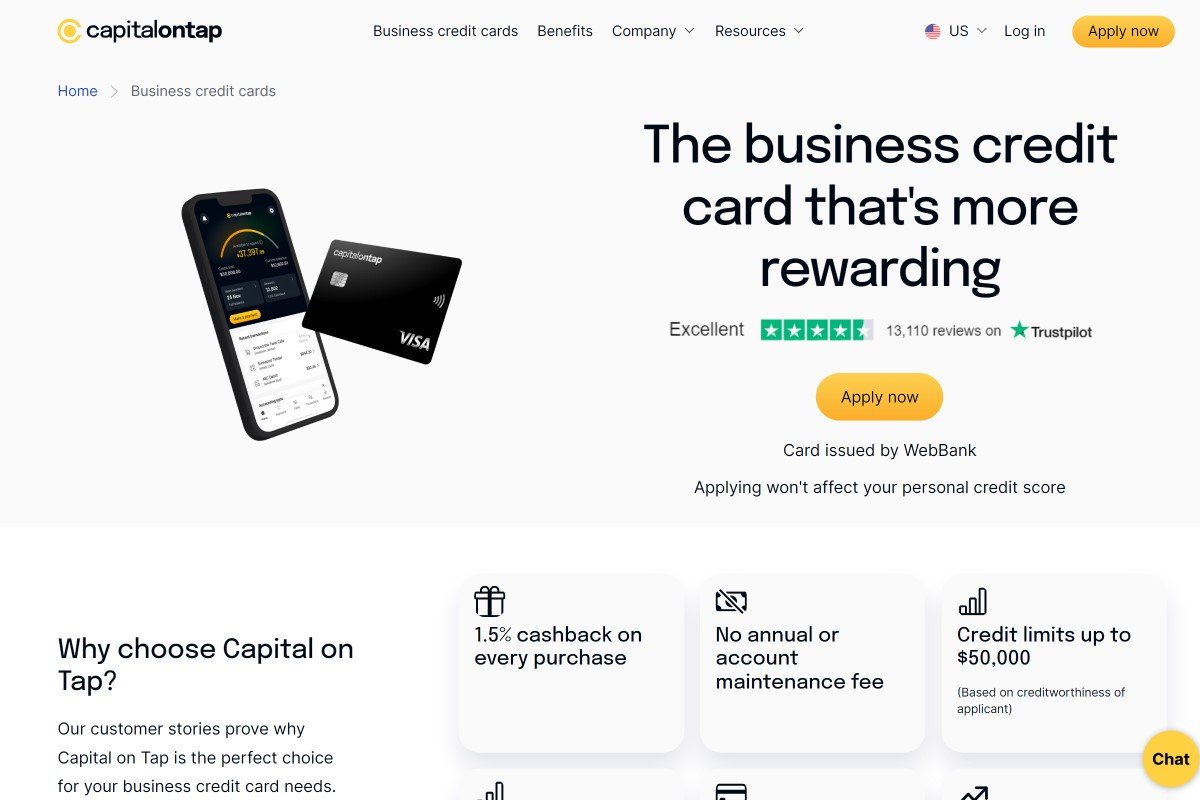

Capital on Tap Small Business Credit Card

When running an online startup, managing finances smartly and efficiently is key to growth. That’s where the Capital on Tap Small Business Credit Card comes in, offering you a flexible way to handle your business expenses while earning rewards. With this card, you get the freedom to spend on what your business needs most, whether it’s software subscriptions, digital marketing campaigns, or office supplies, without worrying about high-interest rates eating into your budget.

This credit card is not just about spending; it’s also about earning and saving. For every dollar you spend, you earn valuable points that can be redeemed for cashback, travel, or other rewards that benefit your business. Plus, with no foreign transaction fees and a straightforward application process, it’s designed to support your startup’s dynamic needs. The Capital on Tap Small Business Credit Card is tailored to help your online business thrive by providing financial flexibility and rewarding your everyday expenditures.

Key Features:

- No annual fee, making it a cost-effective choice for your business.

- Earn rewards points on every purchase, which can be redeemed for cashback, travel, and more.

- No foreign transaction fees, ideal for businesses that operate internationally.

- A generous credit limit, adaptable to your business’s financial needs.

- Easy online management tools to track spending and manage your account efficiently.

Benefits:

- Improves cash flow with flexible spending options.

- Saves money with no annual fee and no foreign transaction fees.

- Boosts your business’s purchasing power with a generous credit limit.

- Rewards your spending, helping to reduce costs with redeemable points.

- Offers peace of mind with comprehensive online management tools.

0% APR for the first 9 months, variable APR after that based on your creditworthiness. No annual fee. Earn 1 point for every $1 spent on purchases.

Starting and running an online startup is an exciting venture, and having the right financial tools can make all the difference. The Capital on Tap Small Business Credit Card is specially designed to support your business’s unique needs, offering not just a way to manage expenses but also a method to earn and save as you grow. With its combination of flexibility, savings, and rewards, it’s the smart choice for any online startup looking to scale efficiently.

Whether you’re funding daily operations or investing in growth opportunities, this credit card gives you the financial leeway to do so without burdening your budget. By choosing the Capital on Tap Small Business Credit Card, you’re not just choosing a financial product; you’re choosing a partner that grows with your business. Apply today and start transforming the way you manage your startup’s finances. For more information and to apply, visit Capital on Tap Small Business Credit Card.

Business Credit Cards

These cards can help you earn rewards, get cash back, and keep track of spending all in one place. Plus, they come with friendly terms that make them easy to use, even if you’re new to business credit. Check out these other business credit cards from top-rated companies and see how they can help your business grow.